Blockchain Technology in Accounting – Automation

Blockchain technology is said to have the potential to completely upend entire industries especially the financial and legal sectors. This technology quickly caught the attention of many of the largest financial institutions but implementation still remains in the experimental phase. This article will lay out some of the benefits of the Blockchain technology in accounting.

Accounting technology in its current state

Digitisation and advances in technology has caused massive disruptions to many industries. But the extent to which such advancements have been able to disrupt the accounting industry has been kept mostly in check by the exceptionally high regulatory requirements that exist in the accounting industry.

The way the entire accounting system is built and designed to discourage and deter forgery and any endeavour to achieve this would be difficult and costly. To achieve this the system relies heavily on mutual control mechanisms, checks and balances. This inevitably impacts day to day operations. In addition to this, there are other measures in place such as systematic duplication of efforts, extensive documentations and periodical controls which all improve validation and integrity. Most of these processes are from from being automated.

The recently emerged Blockchain is a trustless, distributed ledger that is openly available and has negligible costs of use. According to Nicolai Andersen of Deloitte, the use of the Blockchain for accounting use-cases is hugely promising. “From simplifying the compliance with regulatory requirements to enhancing the prevalent double entry bookkeeping, anything is imaginable”.

The giant leap: How the Blockchain may enhance today’s accounting practice

The double entry system forms the basis of modern financial accounting and it once revolutionized the field of financial accounting. Double entry bookkeeping solved the problem of managers knowing whether they could trust their own books. However, the benefits to internal control are not enough and to gain the trust of outsiders, independent public auditors are employed to verify the company’s financial information. Audit exercises are very costly and bind the company’s accountants for long time periods.

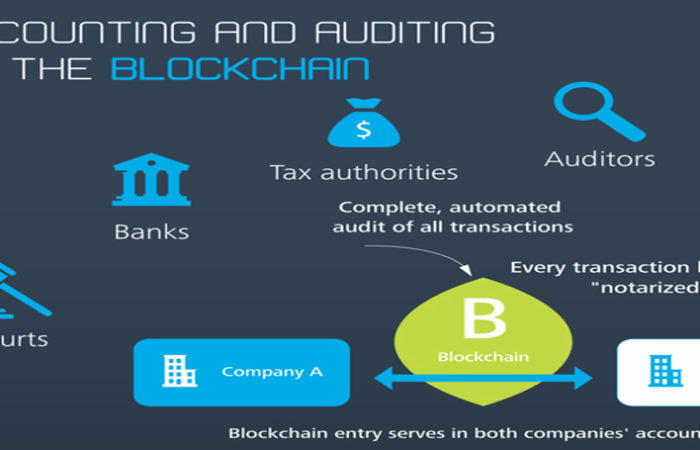

Blockchain technology may represent the next step for accounting with the introduction of triple-entry accounting. Instead of keeping separate records based on transaction receipts, companies can write their transactions directly into a joint register, creating an interlocking system of enduring accounting records. Since all entries are distributed and cryptographically sealed, falsifying or destroying them to conceal activity is practically impossible. It is similar to the transaction being verified by a notary – only in an electronic way.

The companies would benefit in many ways: Standardisation would allow auditors to verify a large portion of the most important data behind the financial statements automatically. The cost and time necessary to conduct an audit would decline considerably. Auditors could spend freed up time on areas they can add more value, e.g. on very complex transactions or on internal control mechanisms.

The blockchain technology has the potential to vastly automate the accounting process and in doing so transform the nature of today’s accounting. There are numerous starting points to leverage blockchain technology most of which have been mentioned. Deloitte predict that cascade of new applications will likely follow that are built on top of each other, leading way for new, unprecedented services.

This Post Has 0 Comments